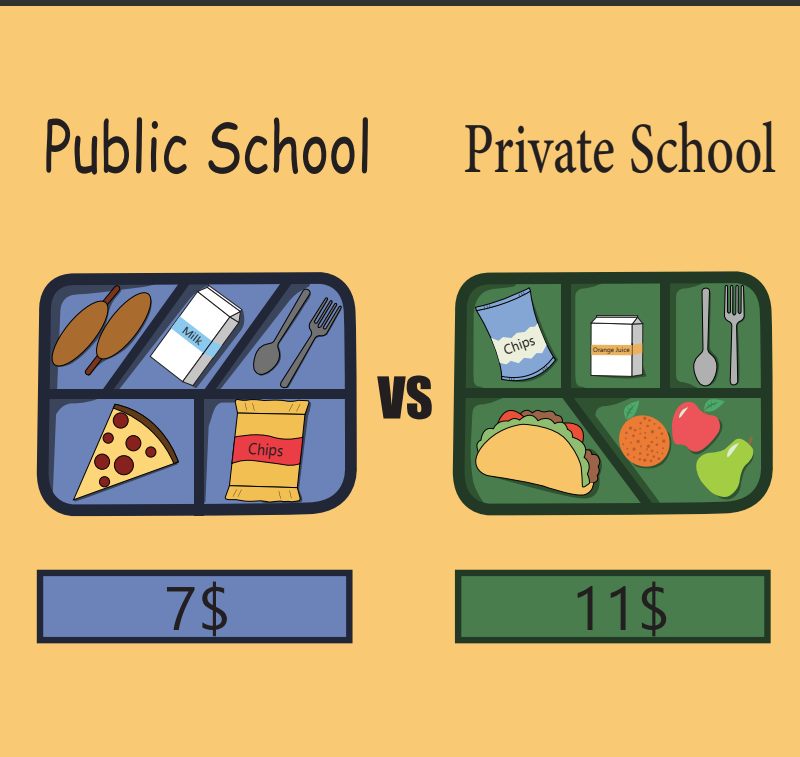

College is expensive–a catchphrase familiar to all within the institution. While tuition itself can range from 9k to over 60k per year, this alone does not account for the total cost of college, or the cost of attendance (COA). While tuition covers the schooling itself, housing, food, and textbooks are all additional costs that add to the COA. The University of Washington Seattle states that their in-state tuition is 11k, but the total estimated COA is 30k. These additional costs include room and board for traditional undergraduates, books, personal transportation, annual student fees, new student enrollment and orientation fee, student tech fee, services and activities fee, facilities renovation fee, intramural activities building, and U-PASS. Additionally, different types of schools have different price tags. Typically, in-state public schools are the most affordable at sticker price for students. Sophomore Ajay Kumar states, “There are different costs based on certain factors, like California schools are really expensive if you don’t live in California.” Out-of-state (OOS) public schools generally charge higher tuition for OOS students to generate revenue for their university. As public universities are state funded, they will receive a subsidized price for tuition as reward for the taxes paid throughout their residence in the state. For this reason, non-state-funded private universities, unlike their public counterparts, will not offer discounted tuition based on residence, rather setting one tuition price for all students.

Due to the large financial burden that college may impose for families, schools offer financial aid for students. Although there are multiple parts to the financial aid process, the first lies with the Free Application for Federal Student Aid (FAFSA). According to the Department of Education’s Federal Student Aid, “You need to complete the FAFSA form to apply for federal student aid such as federal grants, work-study funds, and loans…. In addition, many states and colleges use your FAFSA information to determine your eligibility for state and school aid. Some private aid providers may use your FAFSA information to determine whether you qualify for their aid.” Thus, when applying for financial aid, students’ first step is to fill out the FAFSA. For Washington students, there is also an alternative called the WAFSA, but only one can be filled out – so choose wisely! Senior Akshara Gangilreddy states, “I didn’t know about the WAFSA before this year, because the counselors had a presentation during NEST about the WAFSA, FAFSA, and the cost of college.” According to the Washington Student Achievement Council, “A person should complete the WAFSA if they are undocumented or do not qualify for federal financial aid because of their immigration status…People who complete a WAFSA are applying only for state aid. If you are eligible for federal aid, you should complete the FAFSA in order to maximize financial aid awards.” Thus, the FAFSA is more prevalent, efficient, and is more well-known. However, this year, the FAFSA has changed in multiple aspects.

Previously, the FAFSA utilized input financial information to calculate an expected family contribution (EFC) and used this as a guideline. Recently, FAFSA has renamed the EFC to the SAI (Student Aid Index). FAFSA explains that this is attributed to the confusion that others experience due to the name. EFC, or expected family contribution is sometimes assumed to be the total cost across all four years, which is not the case. Aside from this, certain eligibility requirements have also been modified, with student aid stating, “Incarcerated students in federal and state penal facilities will regain the ability to receive a Federal Pell Grant.”

However, arguably the two most notable changes to the FAFSA this year remain the time of opening and calculation for aid. Contrary to the normal opening in [date], this year, the FAFSA opened on Dec. 31, pushed back to accommodate the various changes implemented this year. In these changes stands the calculation of financial aid as a whole, with Collegedata stating, “The new methodology for calculating aid eligibility required by the FASFA Simplification Act no longer considers the number of family members attending college.” Previously, the EFC was calculated per family, so when another student entered college, the family still contributed the same EFC. With this change, EFC is essentially calculated per student, so now those same families will double their EFC (or SAI this year) when another child enters college. However, Collegedata notes that “individual colleges can consider the financial burden of having many students in school and can adjust offers at their discretion.”

Freshman Arjun Pany notes that other than scholarships, the most notable methods of paying for college would be “with the help of parents or loans.” Junior Sarah Cizek also mentions that another alternative would be to “work throughout college to raise a little money.” Ultimately, there are multiple ways that one can approach paying for college, but in your journey for financial aid, the FAFSA remains a huge tool–one that students should take advantage of.